Vomitoxin in the Corn: Call your agent or office immediately if you discover vitomoxin in your corn. If hauling directly to town, be sure to have the elevator hold a sample if the load has vomitoxin with level 5.1 parts per million or higher. A notice of loss must be submitted to be eligible for a quality loss. Elevator samples must be picked up by an adjuster.

Our News & Events

2024 Billing Information: MPCI & Private Product Interest

No Interest Deferral for 2024

Due to lack of widespread catastrophic weather events and overall favorable weather conditions, the United States Department of Agriculture (USDA) will NOT be deferring interest for the 2024 crop year as they have in past crop years.

Contact your agent for details.

2022 ERP Disaster Program

A couple weeks ago, USDA announced a final deadline for sign up for the ’22 ERP disaster program. That deadline is August 14, 2024! This deadline will apply mostly to Track 2 applications. We have provided a supplemental 1-pager which might be used to simplify the process for your producer customers. Beware- ERP ’22 is a very messy program…the ground has shifted and it will likely shift again because of a pending court case. Regardless, we are advising farmers who think they might qualify (even if for a little bit) to complete the application so they are in the system. We hope this one-pager with a little timeline and history is helpful. As always, call us with any questions.

2023 Interest Waived on Premiums

In accordance with RMA Managers Bulletin MGR-23-004, Farmers Mutual Hail will defer interest charges on MPCI and private product premiums on policies with premium billing dates between July 1, 2023, and September 30, 2023. Interest will be waived to the earliest of an additional 60 days of the scheduled due date or the termination date. Agents will receive an email with additional information. Policyholders will receive a flyer about this interest deferral along with their billing statements.

Prevented Planting

We know it has been a wet spring, and with that thought in mind, we wanted to provide the answers for our clients to some frequently asked questions regarding crops with prevented planting coverage.

Client FAQs

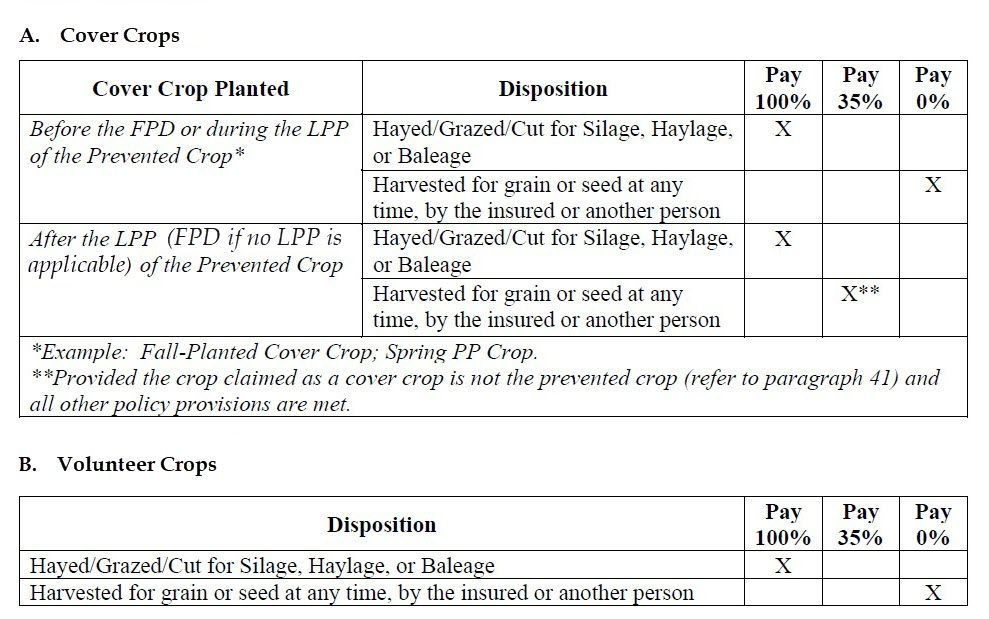

- There are pretty strict limitations on PP acreage as far as trying to get other value out of those acres. If you want to preserve your full PP payment, it’s black dirt or cover crop only.

- If you plant a second crop during the LPP of the PP crop there is NO PP payment.

- If you plant a second crop after the LPP of the PP crop, the PP payment is reduced to 35% of what it would have been. Exceptions to this rule may apply for producers in a double crop area, who have a history of double cropping.

Can I plant a cover crop on the PP acres?

Cover crops may be planted and may be hayed, grazed, cut for silage, haylage, or baleage at any time without impacting the PP payment. However, cover crops cannot be harvested for grain or seed without impacting any potential PP payment. Please note that Corn will not be considered a cover crop on PP acreage. See table below to see how cover crops or volunteer crops may impact PP payments.

Can I rent my PP acreage to my neighbor who wants to plant a cover crop to hay/graze/cut for silage, haylage, or baleage?

Yes. Beginning with 2022 spring crops, it’s now okay to rent to your neighbor for those purposes. Keep in mind, though, that they cannot harvest for grain or seed without impacting any PP payment.

Will my APH database be impacted when I claim and qualify for a PP payment?

The APH database will suffer a yield reduction, but only on acreage where the payment was reduced to 35% because a second crop was planted. Those are the only PP acres that will show in the database and the yield they receive is 60% of the approved yield. PP acreage paid at 100% of the PP guarantee does not impact the APH database at all.

The Back 40 Call

Join the monthly webinar for insider ADM marketing insights on the 4th Tuesday of every month and an opportunity for Question & Answer with ADM Crop Risk Specialists.

Interest Deferral on Crop Insurance Premiums

Farmers and ranchers are facing widespread drought conditions in many parts of the country, causing catastrophic damage to crops. The USDA Risk Management Agency (RMA) has announced flexibilities to help farmers through these challenging times. Farmers Mutual Hail...

2024 Billing Information: MPCI & Private Product Interest

No Interest Deferral for 2024Due to lack of widespread catastrophic weather events and overall favorable weather conditions, the United States Department of Agriculture (USDA) will NOT be deferring interest for the 2024 crop year as they have in past crop years....

Farm Bill Programs

2021 Information

2022 updates coming soon!

Our Story

The Wathen Family Agency

Wathen Insurance was started in the fall of 1982 by Tom and Joyce Wathen. While running a corn and soybean farming operation themselves, the opportunity to help other producers with their risk management decisions was very intriguing and appealing to Tom and Joyce. With a great deal of Passion and genuine interest in their policyholders the Wathen agency grew beyond their expectations, which provided the next generation of the Wathen’s an opportunity to join the business.

Keeping the business in the family provides for excellent quality control while affording attention to detail. We look forward to providing personalized service for our customers in the pursuit of continued success and who knows maybe our next generation will build upon what we started. Thanking you all for our continued success and wishing you a most prosperous year!

Federal Programs

Margin Protection Program

Margin Protection is a crop insurance coverage option that provides producers with coverage against an unexpected decrease in their operating margin caused by: Reduced county yields Reduced commodity prices Increased price of selected inputs Any combination of the…

PRF Program

PASTURE, RANGELAND, FORAGE The Risk Management Agency (RMA) Pasture, Rangeland, and Forage (PRF) Pilot Insurance Program is designed to provide insurance coverage on your perennial pasture, rangeland, or forage acres. This innovative pilot program is based on…

Area Yield Protection

Area Yield Protection (AYP) is designed as a risk management tool to insure against widespread loss of production of the insured crop in a county. AYP is primarily intended for use by those producers whose farm yield tend to follow the average County Yield. AYP is…

Area Revenue Protection

Area Revenue Protection covers against loss of yield due to county production loss and loss of revenue due to a county level production loss, price decline, or combination of both.

Yield Protection

Yield Protection (YP) and Actual Production History (APH) are multiple-peril crop insurance products that provide protection against losses in yield due to nearly all natural disasters.

Revenue Protection

Revenue Protection (RP) and Revenue Protection with Harvest Price Exclusion (RPHPE) are multiple-peril crop insurance products that are based on the Commodity Exchange Price Provisions (CEPP) prices and protects against production loss, price decline or increase, or a combination of both.

Supplemental Coverage Option

The Supplemental Coverage Option (SCO) is a county-level revenue-based or yield-based optional endorsement that covers a portion of losses not covered by the same crop’s underlying crop insurance policy.

Enhanced Coverage Option

Similar to the Supplemental Coverage Option (SCO), the Enhanced Coverage Option (ECO) is a new crop insurance option that provides additional area-based coverage for a portion of the underlying crop insurance policy deductible.

Livestock Risk Protection (LRP)

Livestock Risk Protection is designed to protect against declining market prices. A variety of coverage levels and insurance periods are offered that match the time the livestock would normally be marketed.

Livestock Gross Margin (LGM)

Livestock Gross Margin Insurance provides protection against the loss of gross margin (market value of livestock, or livestock products, minus feed costs). LGM uses futures prices to determine the expected gross margin and the actual gross margin. The price a producer actually receives at market is not used in these calculations.

Private Programs

Wind

Wind with Extra Harvest Allowance is an optional Crop Hail endorsement that provides coverage for wind, green snap, and extra harvest expense for corn that has blown down due to wind damage. It covers ears that cannot be recovered because of flattening, bending, or breaking of the stalk.

Band Coverage

At its core, BAND Coverage is a risk management tool that protects against shallow losses and provides reliable input cost recovery. A lower deductible translates to a higher trigger for the producer’s indemnity, providing support exactly when it is needed.

Revenue Boost

Revenue Boost is a supplemental policy that pairs with most MPCI plans to provide higher coverage and protection to insureds. Want to protect more margin and build a stronger risk management plan? Ask your agent today about Revenue Boost.

Wathen Insurance

5969 State Road 236

North Salem, Indiana

(800) 564-4088

Office Hours

MON – FRI

8 am – 5 pm

SAT – SUN

CLOSED

Drop Us a Line

Don’t be shy. Let us know if you have any questions!