Vomitoxin in the Corn: Call your agent or office immediately if you discover vitomoxin in your corn. If hauling directly to town, be sure to have the elevator hold a sample if the load has vomitoxin with level 5.1 parts per million or higher. A notice of loss must be submitted to be eligible for a quality loss. Elevator samples must be picked up by an adjuster.

Our News & Events

Rotational Grazing and Regenerative Agriculture

A small pasture-based farm located in southwestern Wisconsin is making a big splash with its products and unusual ways of cultivating crops and raising livestock. Unconventional Acres prioritizes sustainability, rotational grazing techniques, improving land health, and animal welfare. Similarly, Blue River Ranch, another small, family-owned farming business out of Hamlin County, South Dakota, focuses on healthy soil, regenerative agriculture, and riverbank easements.

Are these really unconventional ideas, or are they innovative and efficient ways to grow their business?

How Are They Getting the Healthiest Soil?

Both families use rotational grazing as part of their technique in creating the healthiest soil. Establishing and maintaining high-quality soil is challenging in the Midwest, where weather changes in an instant and crop prices jump up and dive down with frequency. One way to avoid disaster is by keeping an updated crop insurance policy. Another way to ensure your soil remains filled with nutrients is rotational grazing.

Rotational grazing is an efficient method to get the most use of your pastures and to maximize beef production per acre. Rational grazing systems implement pasture rotation to eliminate overgrazing while also aiding optimal plant regrowth. This method also allows the same land to be used for grazing many times during a growing season. Some farmers move cattle from paddock to paddock every week, and sometimes even once per day.

The superintendent of the University of Idaho’s Nancy M. Cummings Research, Extension and Education Center, John Hall, assures agricultural entrepreneurs that there isn’t a one-size-fits-all technique in rotational grazing. What matters most is that farmers understand the forage growth phases and the best time to move their livestock. Both Blue River Ranch and Unconventional Acres owners have been using this method for many years, contributing to their enormous success.

Tips on Rotational Grazing Success

Hall has several pieces of advice for farming businesses that are ready to begin rotational grazing.

- Maximize growth phases

- Don’t overgraze any one area

- Learn pasture management skills to adapt to your farm

- Vary your stocking rate (Don’t overstock)

- Adjust your stocking rate to match grass supply

- Use convenient (easily moveable) fencing on irrigated pastures

Why Worry About Regenerative Agriculture? (And What Does It Mean?)

Regenerative agriculture, which some call sustainable agriculture, is the hallmark of Unconventional Acres’ success. To truly focus on regeneration and sustainability, it’s essential that food systems aren’t taking away from the soil or environment in order to maintain Earth’s natural resources.

According to AgFunderNews and Scientific American, approximately one-third of the Earth’s topsoil is already severely degraded. Plus, the United Nations believes that there will be a complete degradation of the world’s topsoil within the next 60 years. Sustainable methods are the only way to combat this escalating issue.

Melissa and Ben, sole owners and first-generation farmers at Unconventional Acres, place their main concern on regenerative agriculture. They do this by combining traditional pasture-based farming with modern science and agricultural technology. Thus, they have the best of both worlds, allowing them to happily achieve farming success while doing so responsibly and sustainably.

Tips on Regenerative Agricultural Success

You may be doing some of these things on your farm already. Here are some extra tips to help Mother Earth remain healthy while you stay in business.

- Use minimal tillage techniques

- Use cover crops

- Implement crop rotation

- Build biological ecosystem diversity using composts or compost extracts

- Carefully manage your grazing practices to increase soil carbon deposits and improve plant growth

- Insure your farming business against low-level production and unexpected income loss

Even those who are tending to a small garden in their backyard can use this advice to keep their lawn and homegrown veggies healthy.

Are you practicing rotational grazing and regenerative agricultural practices already? Give us a call at 765-676-9666 to discuss how you can protect your family’s hard work and hard-earned money. We proudly serve in Indiana and several other surrounding states to keep as many farmers secure as possible.

Are you on Facebook? We are, too! Let’s be friends!

Crop Tissue Testing Can Save Your Farm

During times of uncertainty, whether it’s the weather or the economy, humans feel more positive when they have knowledge that puts them in the driver’s seat. Gaining control of a scary, unknown future situation helps you prep and plan. This is the exact reason that Wathen Insurance exists. We give families security and peace of mind that help them sleep at night with insurance programs that protect a precarious future in farming. And, that’s why crop tissue testing is something you should be doing on your farm.

What is Crop Tissue Testing?

Using diagnostic tools on your crops isn’t much different than a doctor diagnosing a patient. Plant tissue analysis is an underutilized and undervalued monitoring tool that you should take advantage of.

Crop tissue testing is calculating the nutrient content of a plant. Understanding if a crop is deficient in a particular nutrient could explain stunted growth or off-colored crops. One mistake farmers often make is taking tissue samples of only plants that look weak or of poor quality.

However, you should use this kind of investigative tool before plants begin looking less than their best. You want to know what you’re doing right as well as what needs improvement.

Take plant tissue samples from several areas and include healthy plants, and plants that look deficient. Because soil varies wildly across the landscape, you’ll be able to capture information that tells you how to get a successful uniform crop every season.

A crop tissue testing lab will show you the nutrient status of the following critical components of each plant:

- Nitrogen

- Boron

- Calcium

- Copper

- Sulfur

- Phosphorus

- Potassium

- Magnesium

- Sodium

- Iron

- Manganese

- Zinc

Why is Crop Tissue Testing Important?

Taking tissue samples of young plants help you get ahead of potential problems. This will allow you to make corrections at critical growth stages that optimize crop fertility. The more you understand about the nutrient content of a crop and its relationship to the soil and yield, the more robust your plants will be every year.

Agriculturists agree that crop tissue testing is valuable in order to:

- Recognize nutrient deficiencies, toxicity, and imbalances

- Foresee possible weaknesses in current or future crops

- Validate how effective your current fertility method is

- Forecast needs for various critical nutrients at crucial growth stages

- Assess nutrients to develop future budgets

- Verify the value of the crop as animal feed

- Accurately develop a succession or crop rotation plan

If you aren’t already familiar with crop tissue testing, seek advice from a specialist to get you started. They’ll know when, where, and how to properly handle and deliver samples to a lab, and they’ll also help you understand how to interpret the analytical results.

Once you understand the nutrient content of your crops, consider ensuring their safety and success with crop insurance. Give Wathen Insurance a call at 765-676-9666 to discuss your options.

Are you on Facebook? We are, too! Let’s be friends!

Farmers in the 19th Century: How Much has Really Changed?

Believe it or not, the art and the science of farming hasn’t changed much over the last century. Some things that have changed are selective breeding, the creation of pesticides and fertilizers, and the integration of modern machinery. Despite these improvements over the years, farmers still face some of the same hardships.

Expansion

During the early 19th century, farmers had to be flexible and diverse in their agricultural occupation. They raised lots of different animals, from chickens to pigs, from cattle to sheep. The expansion didn’t stop there. Farmers from long ago planted many different crops instead of focusing on one or two, and they didn’t consider crop rotation during that time. On 80 acres of land, a farmer planted wheat, oats, corn, barley, pumpkins, beans, radishes, and more.

As the 20th century neared, farm machinery was made widely available and affordable. Along with affordability, these new machines were innovative, allowing agricultural specialists to focus on only one or two crops, and perhaps only a few animals, while still earning adequate profit.

Education

Farmers were able to make more money by diversifying less, which means they had to learn new technologies as their farms and families grew. That hasn’t changed one bit from a century ago. Agricultural technology grows in leaps and bounds in an everchanging farm-dependent society. Therefore, farmers now have to keep up with education, business skills, and advanced technical knowledge of machinery. Just like farmers from long ago, present-day agriculturists must always be honing their skills.

Sustainability

Inheriting, building, or growing a farm successfully all depends upon sustainability, just as it has in decades past. For example, the agricultural industry is always changing and adapting as ecosystems transform, and climate change occurs. From small-scale, single-family farms, to huge farming giants, agricultural productivity all hinge upon a sustainable food systems model. Unlike farmers in the 19th century, though, the current challenges facing today’s farmers are much easier to mitigate and prevent.

Weather

Another consistent theme in farming throughout the centuries is out-of-control weather. Yes, it may be 2020, but we still can’t control tornados and tsunamis. Farmers today, just like the farmers in the 19th century, lose crops to drought, hail, and cold weather. However, luckily, agricultural specialists now rely on federal and private insurance programs to protect their livelihoods from lousy weather or loss of revenue.

Farmers in the 19th Century

The United States relies on today’s farmers, just as citizens did in the 19th century. Just like in the past, most farms are family-owned, passed down from generation to generation. We know just how hard farmers in the Midwest have to work to not only put food on their own tables, but they also strive to put food on the table of Americans across the land.

We understand your worries and concerns, from one family-owned business to another. Call Wathen Insurance today at 765-676-9666 to talk about all the ways we can ease your fears in today’s farming landscape.

Are you on Facebook? We are, too! Let’s be friends!

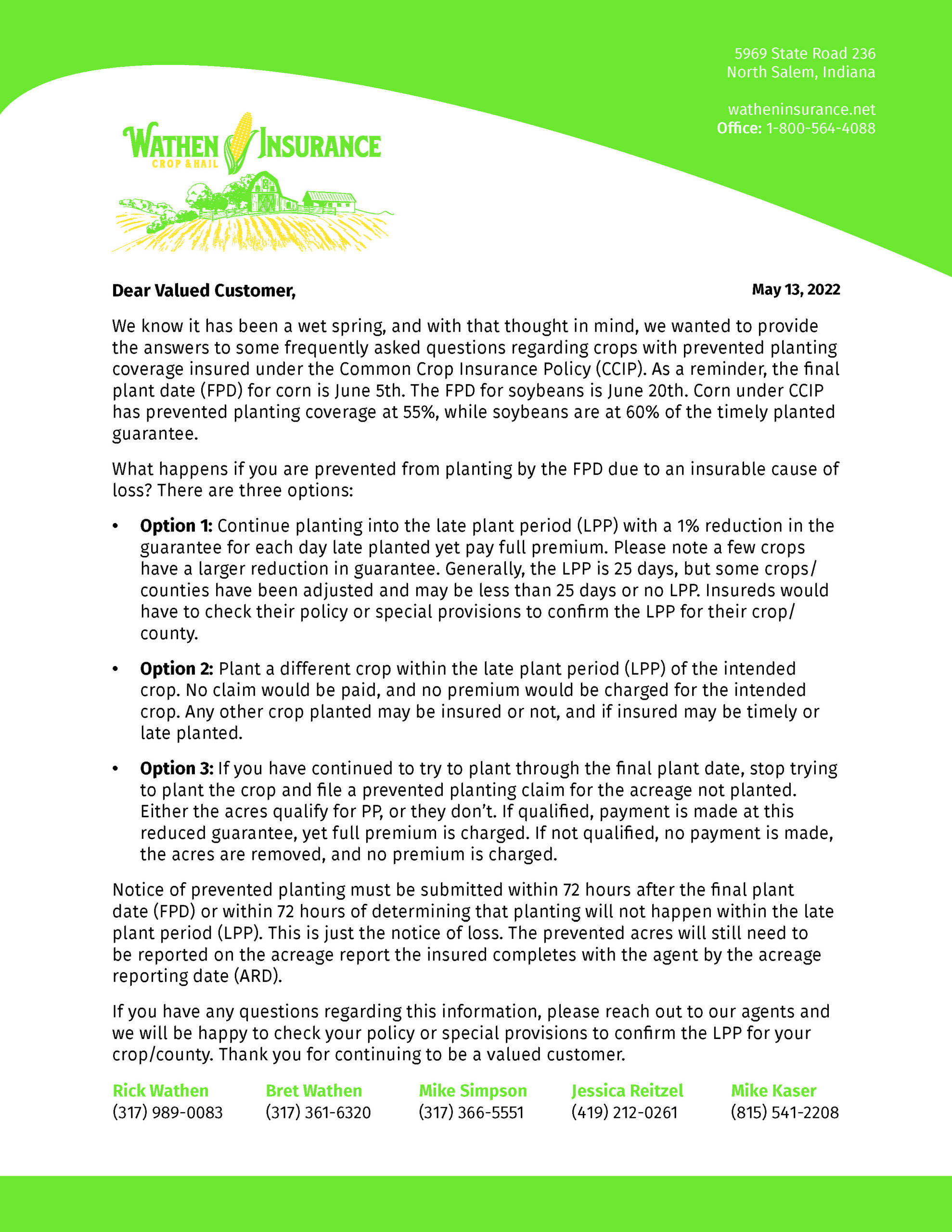

Prevented Planting

We know it has been a wet spring, and with that thought in mind, we wanted to provide the answers for our clients to some frequently asked questions regarding crops with prevented planting coverage.

Client FAQs

- There are pretty strict limitations on PP acreage as far as trying to get other value out of those acres. If you want to preserve your full PP payment, it’s black dirt or cover crop only.

- If you plant a second crop during the LPP of the PP crop there is NO PP payment.

- If you plant a second crop after the LPP of the PP crop, the PP payment is reduced to 35% of what it would have been. Exceptions to this rule may apply for producers in a double crop area, who have a history of double cropping.

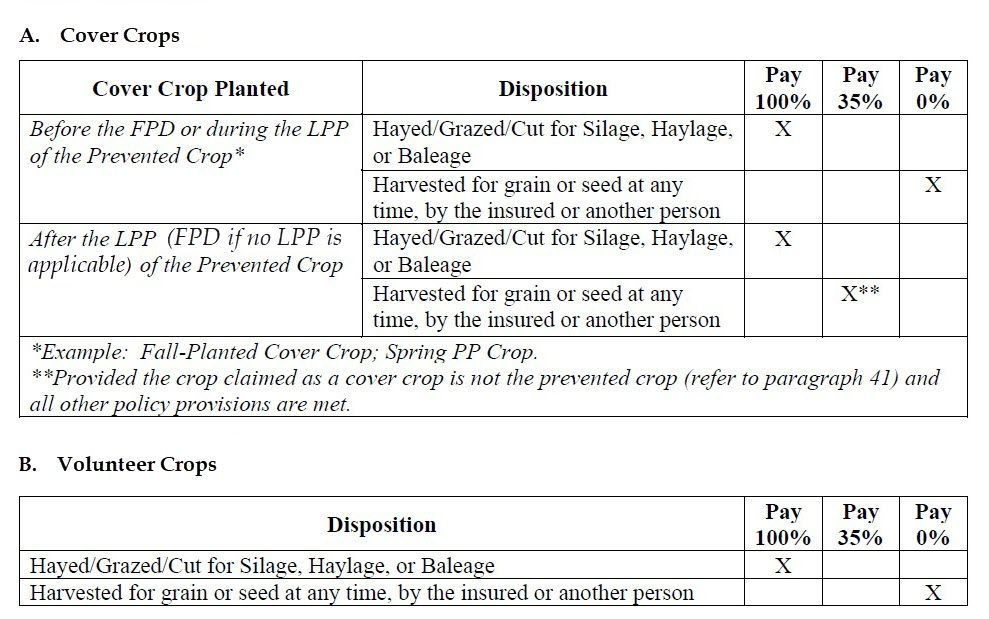

Can I plant a cover crop on the PP acres?

Cover crops may be planted and may be hayed, grazed, cut for silage, haylage, or baleage at any time without impacting the PP payment. However, cover crops cannot be harvested for grain or seed without impacting any potential PP payment. Please note that Corn will not be considered a cover crop on PP acreage. See table below to see how cover crops or volunteer crops may impact PP payments.

Can I rent my PP acreage to my neighbor who wants to plant a cover crop to hay/graze/cut for silage, haylage, or baleage?

Yes. Beginning with 2022 spring crops, it’s now okay to rent to your neighbor for those purposes. Keep in mind, though, that they cannot harvest for grain or seed without impacting any PP payment.

Will my APH database be impacted when I claim and qualify for a PP payment?

The APH database will suffer a yield reduction, but only on acreage where the payment was reduced to 35% because a second crop was planted. Those are the only PP acres that will show in the database and the yield they receive is 60% of the approved yield. PP acreage paid at 100% of the PP guarantee does not impact the APH database at all.

The Back 40 Call

Join the monthly webinar for insider ADM marketing insights on the 4th Tuesday of every month and an opportunity for Question & Answer with ADM Crop Risk Specialists.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Post-Application Coverage Endorsement

The PACE program provides insurance for conservation-minded corn farmers who split-apply nitrogen fertilizer. The Post-Application Coverage Endorsement is the latest result of the RMA’s recent efforts to reward conservation and sustainable farming among American...

Farm Bill Programs

2021 Information

2022 updates coming soon!

Our Story

The Wathen Family Agency

Wathen Insurance was started in the fall of 1982 by Tom and Joyce Wathen. While running a corn and soybean farming operation themselves, the opportunity to help other producers with their risk management decisions was very intriguing and appealing to Tom and Joyce. With a great deal of Passion and genuine interest in their policyholders the Wathen agency grew beyond their expectations, which provided the next generation of the Wathen’s an opportunity to join the business.

Keeping the business in the family provides for excellent quality control while affording attention to detail. We look forward to providing personalized service for our customers in the pursuit of continued success and who knows maybe our next generation will build upon what we started. Thanking you all for our continued success and wishing you a most prosperous year!

Federal Programs

Margin Protection Program

Margin Protection is a crop insurance coverage option that provides producers with coverage against an unexpected decrease in their operating margin caused by: Reduced county yields Reduced commodity prices Increased price of selected inputs Any combination of the…

PRF Program

PASTURE, RANGELAND, FORAGE The Risk Management Agency (RMA) Pasture, Rangeland, and Forage (PRF) Pilot Insurance Program is designed to provide insurance coverage on your perennial pasture, rangeland, or forage acres. This innovative pilot program is based on…

Area Yield Protection

Area Yield Protection (AYP) is designed as a risk management tool to insure against widespread loss of production of the insured crop in a county. AYP is primarily intended for use by those producers whose farm yield tend to follow the average County Yield. AYP is…

Area Revenue Protection

Area Revenue Protection covers against loss of yield due to county production loss and loss of revenue due to a county level production loss, price decline, or combination of both.

Yield Protection

Yield Protection (YP) and Actual Production History (APH) are multiple-peril crop insurance products that provide protection against losses in yield due to nearly all natural disasters.

Revenue Protection

Revenue Protection (RP) and Revenue Protection with Harvest Price Exclusion (RPHPE) are multiple-peril crop insurance products that are based on the Commodity Exchange Price Provisions (CEPP) prices and protects against production loss, price decline or increase, or a combination of both.

Supplemental Coverage Option

The Supplemental Coverage Option (SCO) is a county-level revenue-based or yield-based optional endorsement that covers a portion of losses not covered by the same crop’s underlying crop insurance policy.

Enhanced Coverage Option

Similar to the Supplemental Coverage Option (SCO), the Enhanced Coverage Option (ECO) is a new crop insurance option that provides additional area-based coverage for a portion of the underlying crop insurance policy deductible.

Livestock Risk Protection (LRP)

Livestock Risk Protection is designed to protect against declining market prices. A variety of coverage levels and insurance periods are offered that match the time the livestock would normally be marketed.

Livestock Gross Margin (LGM)

Livestock Gross Margin Insurance provides protection against the loss of gross margin (market value of livestock, or livestock products, minus feed costs). LGM uses futures prices to determine the expected gross margin and the actual gross margin. The price a producer actually receives at market is not used in these calculations.

Private Programs

Wind

Wind with Extra Harvest Allowance is an optional Crop Hail endorsement that provides coverage for wind, green snap, and extra harvest expense for corn that has blown down due to wind damage. It covers ears that cannot be recovered because of flattening, bending, or breaking of the stalk.

Band Coverage

At its core, BAND Coverage is a risk management tool that protects against shallow losses and provides reliable input cost recovery. A lower deductible translates to a higher trigger for the producer’s indemnity, providing support exactly when it is needed.

Revenue Boost

Revenue Boost is a supplemental policy that pairs with most MPCI plans to provide higher coverage and protection to insureds. Want to protect more margin and build a stronger risk management plan? Ask your agent today about Revenue Boost.

Wathen Insurance

5969 State Road 236

North Salem, Indiana

(800) 564-4088

Office Hours

MON – FRI

8 am – 5 pm

SAT – SUN

CLOSED

Drop Us a Line

Don’t be shy. Let us know if you have any questions!